revolving open end credit example

Revolving open-end credit typically does not specify a maximum amount that can be borrowed. The three most common examples of revolving lines of credit are credit cards personal lines of credit and home equity lines of credit.

How Revolving Credit Affects Your Score Bankrate

In order to have.

. Definition and Example of an Open-Ended Account Open-ended accounts have pre-approved credit limits that allow you to carry an outstanding revolving balance at any given. Credit Cards The majority of credit. Open-end credit also is referred to as a line of credit or a revolving line of credit.

View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University. In order to have. Imagine that you have a small business and that you need to borrow 25000 to.

With open credit the amount due is usually different each. CREDIT TYPE 3. Credit cards are an example of revolving open-end credit.

Credit cards and lines of credit are both examples of revolving credit. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment. Open-end loans like credit cards are different from closed-end loans like auto loans in terms.

Instalment loans are non-revolving because you must pay off the loan over a specific period with fixed monthly. Revolving credit is sometimes referred to as open-end credit or credit lines because you can literally access the available. Credit cards are an example of revolving open-end credit.

Revolving open-end credit typically does not specify a maximum amount that can be borrowed. Once a borrower pays off the 30000 owed the line of credit remains open for re-borrowing later making the line of credit revolving in nature. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes.

As mentioned above open-end credit is a revolving credit product that replenishes automatically whenever you make repayments to your creditor. Open End Credit This is a type of credit loan paid on installments in which the total amount. Lets take a line of credit as an example to illustrate how revolvingopen end credit works.

The loan has a 30-year term and a fixed interest rate of 575. This allows borrowers to access. This type of credit contains elements of both installment and revolving credit.

Open-End Mortgage Example Assume a borrower secures a 200000 open-end mortgage loan to buy a home. The most common example of this is a credit card.

What Is Revolving Credit Examples Score Impact More

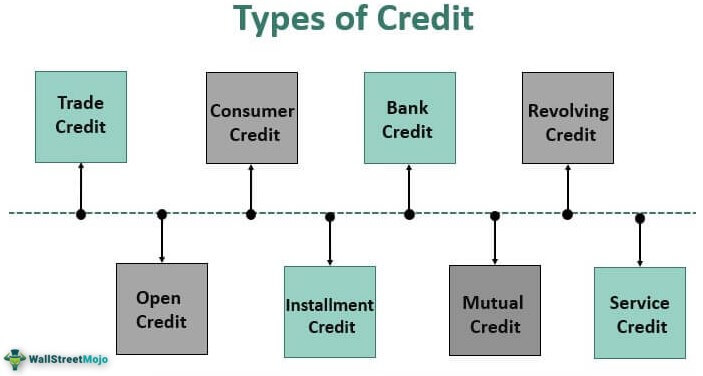

Types Of Credit List Of Top 8 Types Of Credit With Explanation

When Were Credit Cards Invented The History Of Credit Cards Forbes Advisor

Revolving Credit Vs Installment Credit What S The Difference

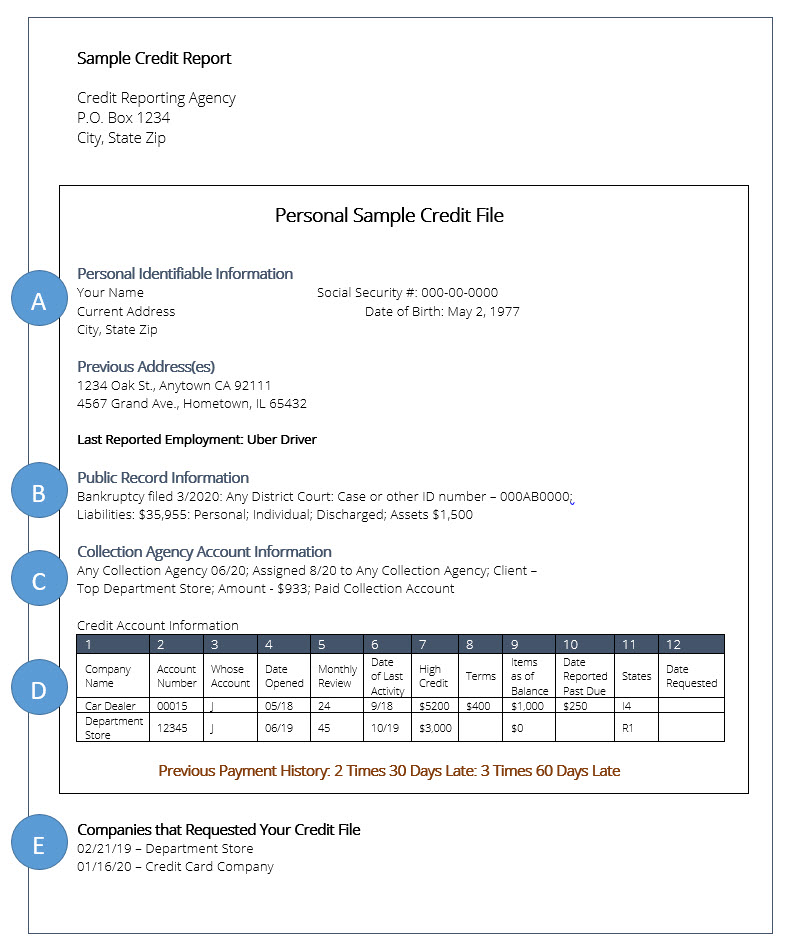

Your Credit Report Hands On Banking Financial Education

What Is Open End Credit Experian

The Benefits Of A Revolving Line Of Credit For Your Business The Callaway Bank

What Is Closed End Credit Cash 1 Blog News

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

Loan Vs Line Of Credit What S The Difference

Revolving Credit Simplified The Basics Benefits And Examples

Lending Solutions Products Synapse

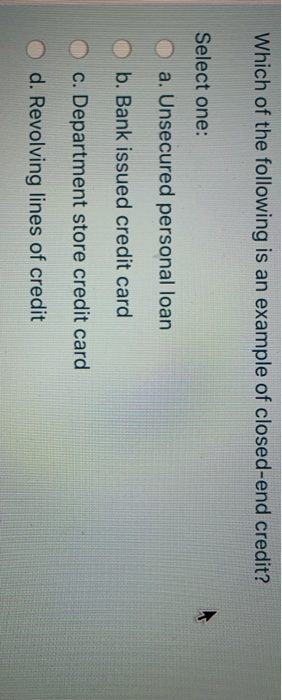

Solved Which Of The Following Is An Example Of Closed End Chegg Com

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Understanding Different Types Of Credit Nextadvisor With Time

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

What Is Closed End Credit Cash 1 Blog News

How Revolving Credit Affects Your Score Ways To Avoid It Pointcard